|

From

Buyincomeproperties.com How To Articles

Investing in real estate will get easier the more you do it. The first deal may take some time, but like anything, the more you do it the better you'll become. Here are some guidelines for investing in real estate.

Establish how much you can borrow:

Know your limits. Don't go looking for $400,000 houses when you can only afford a $200,000 house. Before you invest real estate you must know how much you can borrow from your lender. This can be anywhere from 80%-100%. If you are investing for the first time, banks will most likely only want to lend you 80%-90%. Once you've established good relations with the bank after five to ten deals, they will most likely be willing to cut you better deals and offer 100% financing.

Some private lenders may offer you mortgages and home equity loans of 100%-125%, be careful with these especially if they are individuals. Their motives are often only profit.

Most people dread seeing their banker, hoping that THEY will approve your loan application. However from my experience, you need to show the bank who's boss. By this I mean:

- Do not deal with only one bank, big mistake. Deal with lots of other banks and let the banks know about it. Send out your loan application to as many banks as you like. The best bank that comes back with the best deal wins. - Always negotiate, just because the "Offered interest rate" is 6% does not mean that they will not lend you lower. Be persistent and confident if you are going to ask for a lower interest rate.

Other things to keep in mind before applying for a loan:

Another choice you must make is whether to make the loan an interest only one or a principal and interest loan. I generally prefer to take out interest only loans for several reasons. You will get more cash flow from a property if the payment is interest only. This can go straight to your pocket or cover and unexpected payments with the property. You will also be able to borrow more because you make smaller payments. You may also have the option of paying off the rest of the principal at a later time. Depending where you live, you might also get a tax advantage for taking out an interest only loan. Also, why would you want to pay off debt on something that is already putting money in your pocket and appreciating in value? Wouldn't the money be better spent on a deposit on another rental property which will give you more cash flow. I know I would rather owe 80% on thirty properties earning me $3,000 a year than two or three properties that I have no debt on.

Does this mean you can't take out a principal and interest loan? Of course not! If that's what you really want to do and you still make money on the property, go for it.

Asset protection:

A house will most likely be your biggest and most expensive asset, you'll certainly want to protect it. There are three ways you can do this. Physical protection, corporate protection, and insurance protection.

Physical protection is what you can change in the properties structure to protect it. So you could go as far as building a moat around the property! The first step would be to not buy a house in areas of high crime or natural disaster such as earthquakes or landslides. Then think about installing security systems, burglar alarms, and fences.

Having your property in a corporate entity such as a limited liability company, corporation, or trust provides legal security and possible tax breaks. This all depends on where you live, so it is important to look into this type of protection if you are thinking about buying a lot of properties.

Insurance is the third type of protection. Many insurance companies or even banks will give you good rates for insurance on an investment property. This is because they consider a house a very safe investment! You can get insured on all kinds of things, like earthquakes, depending on how much you want to pay. Be sure to find out the cost of insurance before you buy a property as well so you can input it into your budget calculations.

There is no I in team:

Analyzing and finding the right property deals:

Firstly read the article on how to Buy the property at a discount, this will cover the basics on how to buy property at a lower than market value price. This is very important because It can completely change the aspects and financing the deal. It is also good to have more equity than just your deposit on the house because you have created instant wealth and because now you will have more equity compared to debt than what the bank had planned the loan for, enabling you to take out bigger and more loans faster. You will also be able to borrow money against your home to help you finance the property 100% if needed.

So aside from buying the rental property below market value you need to look at several other factors. Like the income from rent, interest rates and amount borrowed, expected growth, possible improvements, and other expenses.

Rent can be found from asking people who live in the area, real estate agents, and by property management companies.

Growth can be found from finding previous valuations of the property usually done by the government department in charge of housing, varies from country to country. If you can see how much the property increases by value from year to year you can usually get a good indication of what the capital gains percentage is.

Expenses will consist of insurance for the property, interest payments on the mortgage, any taxes you may have to pay, unexpected repairs such as a toilet breaking, property management fees, closing costs for when you purchase the property and maintenance fees such as electricity (can be passed on to tenant).

Renovation can be used to increase equity and weekly rent. Look here to for some good home improvement ideas. This is important because if you can increase weekly rent the figures will change.

Lets look at this example

The key now is...Don't get emotional:

I'm sure you noticed how every figure in the previous paragraph is in bold. This is because as long as the figures work out to make you money, EMOTIONS DON'T MATTER ONE BIT! Just because the property has a really nice garden, do not show you think that and be willing to pay extra for it. You aren't going to be living in the house so do not buy a house which you want to live up your living expectations. You will also loose your negotiating edge when getting emotional.

One of the worst times to show your emotions is if you are trying to buy the property at an auction. Auctions are designed to put pressure on the buyers. Never go above your limit because of a quick emotional decision, this could lead to huge financial disasters. Also, with auctions don't bid at all until you are very close to the "Third and final call".

Settling and contracts:

The two most important things when it comes to writing a contract or sales and purchase agreement are that you have someone with legal advise and experience in property help you write it (a solicitor), and that you always have a legal way out of a potentially bad deal.

If you are looking to put the property into an asset protection structure, a good idea is to write your contracts under "As nominee" instead of your real name. This will allow you to legally buy it and put it into the asset protection structure.

One of the best things about real estate is that the contracts you can enter can be very flexible if needed. Sales and purchase agreements can be drawn for such purposes as renovating or finding tenants. Say for example you could include clause saying that you have six months to work with the house before you pay the money, or one month to find a tenant before you pay for the house to prevent a loss in revenue.

Due diligence is a way for both parties, the buyer and seller, to get out of the deal. If you can word a due diligence period of a few days into the contract you would have a few days to review the property and if unsatisfied with what you purchased, get out of the deal.

Property manager or should you manage your own property?

Now is the time to decide if you would like to use a property manager. I always use one because I can not be bothered fixing a toilet or shower at three in the morning. Property managers will take care of almost everything for you so you have more time. Some will even find tenants for you. Property managers will usually charge a small commission percentage. Some people argue that you shouldn't pay someone to manage your asset. I disagree because If you spend most of your time repairing and looking after one rental property, you will not have time to find new property deals.

If you choose to manage your own property take these few points into consideration:

Where to from here:

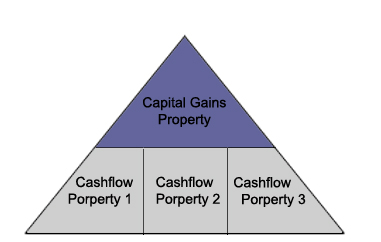

One property is great, but It wont make you very wealthy. Below is the expansionary model of what I think a good real estate portfolio should look like.

The Real Estate Investment Pyramid

How this works is simple. Acquire three positive cash flow properties which help support a larger capital gains property. Lets look at the example:

Cash flow property 1, worth $80,000 returns $1750 dollars a year with capital growth of 3.5% Cash flow property 2, worth $70,000 returns $1200 dollars a year with capital growth of 4% Cash flow property 3, worth $120,000 returns $2500 dollars a year with capital growth of 2% Capital gains property, worth $250,000 returns -$500 dollars a year with capital growth of 12.5%

As you can see the capital gains property looses money. The reason why the model is in a pyramid shape is because the cash flow properties support the capital gains property.

Why don't I just by all really high growth properties with cash flow? You can! It's just that finding a property with very high cash flow and a high growth percentage might take more time and could be more harder. Really, there's nothing stopping you but It will generally be easier to find cash flow properties and capital gains properties.

So why should I do this?

In five years time cash flow property one will be worth $95,000. Cash flow property 2 is worth $85,000. Cash flow property 3 is worth $132,500. The capital gains property is now worth $450,000! The whole investment portfolio is now worth $762,000. If we assume the mortgages on all the properties was 90%, you now have $294,000 of equity you can use!

You could sell all the properties and make a nice profit of $294,000 but you'd probably have to pay a capital gains tax of 33% (depends on where you live) not to mention real estate agent fees. Perhaps we could use the profit as a down payment on another property, tax free.

1030 Tax Exchange Example

In America a good strategy is that when you make capital gains from a property you should sell it and buy a more valuable property. Normally you would be taxed but not if you use the 1030 tax-deferred exchange. This entails, using the profits of the real estate properties which you sold to reinvest in a more valuable property. So if we look at the previous example, you now have $294,000 which you can use on a deposit for a new property.

Lets say you buy a larger rental property with a deposit of $294,000 dollars. If you can get 90% financing you can buy an asset worth $2,940,000! Just imagine how much cash flow you could get from a property worth that much!

However, there is little room to "Do it yourself" while using the 1030 tax exchange. The money must be held by a qualified accommodator until you purchase the property. You will have 45 days to draw up a list of potential properties you will buy. You also have 180 days to settle on a property. The properties must also be similar, for example you can sell a bare piece of land and buy a bigger bare piece of land. This is why It's important to talk to an accountant or an attorney before you try this.

This article is a general guideline on

how to invest in property, residential in specific. If you are seriously considering buying

property try to take in some knowledge from this article. Don't stop

there though. Because real estate investing can involve so many tax

advantages and laws, learn more about real estate investing in your

country/state so you can become an expert.

© Copyright 2004 by Buyincomeproperties..com |